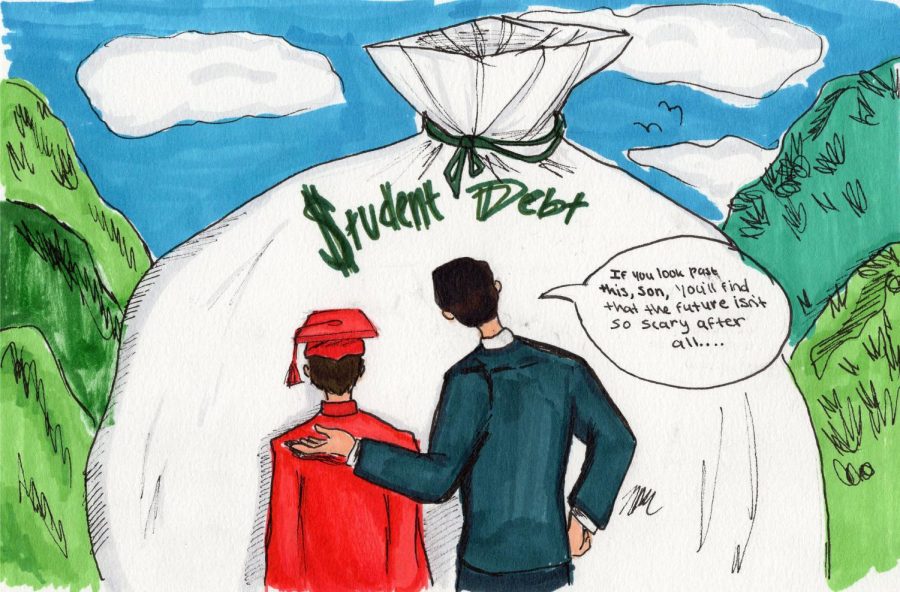

Is it worth it? There are ways to avoid the debt that often comes along with college

January 17, 2020

Students begin worrying about overwhelming college debt while still in high school, but there are advisers are available to help students learn how to tackle debt — they provide skills and opportunities that can be taken advantage of.

“There is A+ and going to a community college — we always assume that it has to be [Ozarks Technical Community College], but we just assume that because OTC is close,” Joy Horgan, college and career counselor of seven years, said. “You can go to any community college in the state of Missouri and use A+ money to pay for that.”

Special education teacher Madison Whelan used A+, AP and dual credit classes, and still ended up with debt — but less than what she would have had. She had to take out loans for living and book expenses starting her sophomore year.

“Do A+ for sure, no matter what, those two years can give you more advancement in the workplace,” Whelan said.

There are often requirements students must meet to gain the scholarships, but writing an essay is easier than paying an extra $500 or more for classes.

“Nobody is going to come find you for scholarships, it is your job to go look for them,” Kelly Evans, associate director of Missouri State University’s financial aid, said.

MSU has automatic scholarships that are attached to admission applications — based on ACT score and GPA — for college freshmen only. There are also foundation scholarships, which are donor-funded, and there is only one application for all of them that must be completed every year for scholarship renewal.

“I also post any scholarship that I find, that comes across my desk,” Horgan said. “I post it on the counseling webpage.”

The webpage link is available on the counselors’ Canvas page. Fastweb.com and scholarship.com allow students to create profiles to help narrow down scholarships suited for them. Apps like Scholly are helpful, but cost money to not have the student’s name sold — which is how search engines make money. Be aware of other scholarship sites that cost and don’t trust sites that ‘promise’ money.

There are local scholarships that are given to Nixa seniors only from groups like Nixa PTA and the Athletic Booster. Many students do not apply for these, unfortunately.

Government loans and grants are for conquering debt as well.

“FAFSA is the Free Application for Federal Student Aid,” Evans said. “There are a lot of sites that mimic the FAFSA, so it is important to go to .ed.gov. If it is not a .ed.gov site, back out right away.”

FAFSA determines which students fall in the financial range of certain grants like the Pell Grant. Other federal and state grant programs are determined by what is filled out on the FAFSA form.

“It can be intimidating the first time around, [but] it shouldn’t be,” Evans said. “It’s gotten easier and easier as the years have gone on. I think I filled out an 18 page paper copy when I went to school. [Now] you can get it done fairly quickly — 30 minutes, [up to] an hour if you’ve got some really complicated taxes.”

High school or university counselors can assist with FAFSA questions. Many schools, like Nixa, have a ‘FAFSA Night’ where families can fill out the forms with counselors ready to help.

Debt seems inevitable, so taking time to understand how to stay on top will improve students’ ability to pay off debt.

“I don’t know that you can always prevent it,” Evans said. “[But you can try] by understanding what your budget is first, and then applying for scholarships … The other thing they can look at is housing options. Are you staying in the most expensive housing or the least expensive housing?”

When students go to college somewhere local, staying at home is the best economic option. Not eating out or shopping helps save money too.

“Don’t buy books from the school,” Whelan said. “Get them online or rent them. Life changes, but try to have a plan. Communicate if you’re going to use your A+ money. Figure out for sure and have those hard discussions with your parents about what they’re willing to pay for. Plan for the worst just in case — like if something bad happens, have a back up plan.”

Even if it seems like everything will go fine financially, be prepared for expensive hiccups. Taking advantage of AP and dual credit classes while in high school will pay off as well.

“Even though it’s $80 to sometimes $300, it seems like a lot now, but it’s so worth it,” Whelan said.

High schoolers may be afraid of dual credit classes costs, but it becomes more expensive in college. Students must weigh out possibilities so that they don’t incur massive debt they don’t need.

“I give the example of my daughter: She wanted to be a teacher, and she went to MSU for four years,” Horgan said. “Some of the schools she was looking at had an education degree, but they were very costly. Why would you go to this school when you could go to Missouri State — you know, they started out as a teacher’s college so it’s a good school to go to, and they’re cost effective for your degree.”

The price of the education compared to the job that is to follow will determine how much debt will be made.

“If you’re going to major in medieval literature, maybe don’t take out $60,000 in debt,” Evans said. “If you’re taking out $60,000, and you’re going into med-school — whole other scenario. It is an investment in your future; that doesn’t mean you have to invest a ton.”

It’s hard to avoid debt even when students go to cost effective schools for their major. Sometimes plans change that add to the price tag.

“I went to two junior college schools, and I wish I would have communicated more with the university I wanted to transfer to — I went to Missouri State — because I ended up having to go to three more years instead of just two because the credits didn’t transfer quite right,” Whelan said.

When things go wrong in college, it is important to stay on top of everything and focus on the amount of money that is available to spend.

“You don’t have to go to Starbucks everyday,” Horgan said. “Set your budget. Stick to your budget. It’s OK to be broke because it’s what college is about, really. You don’t have to have the best of everything.”

She encourages students to save student loans in their bank account and only use them for what is needed. Then when the semester is over, pay back everything that wasn’t used.

“We always say, ‘live like a college student now, so you don’t have to live like a college student when you’re 40,’” Evans said.

While in school, having a job on or off campus, applying for scholarships, and being a part of organizations that have scholarships involved help students get rid of debt early.

“I did work on and off — which I planned to work the whole time, but it’s hard working and going to school,” Whelan said. “I give myself grace because when I was working, it was nice financially, but also it made it really hard going to school.”

Universities often have on-campus jobs for students to take advantage of. Of course, working and going to school doesn’t work well for everyone.

“If a student gets to the point where basic necessities aren’t being met, it’s really important to go seek help at their school,” Evans said.

Schools, like MSU, have food pantries for their struggling students and housing assistance. Colleges want to help their students, because if basic necessities aren’t being met, students will struggle academically on top of mentally and physically.

“Debt stinks,” Whelan said. “It’s not the end of the world because it can get you places.”